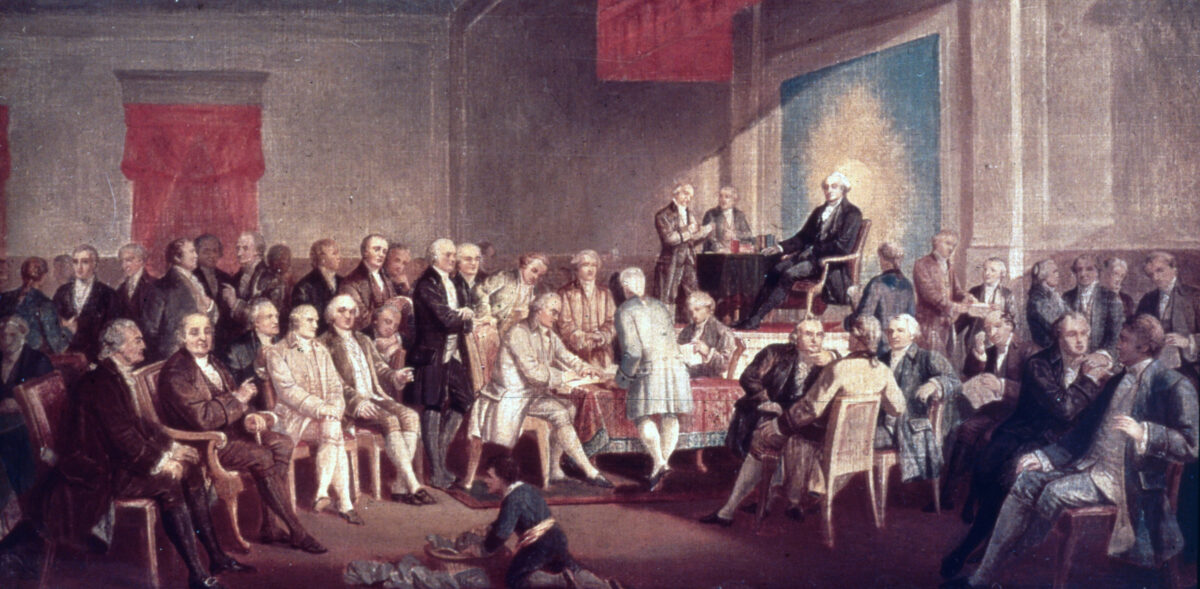

1787: The painting Signing the Constitution of the United States by Thomas Pritchard Rossiter. The painting, painted in 1878, resides at Independence National Historical Park, Philadelphia, Pennsylvania. (Photo by MPI/Getty Images)

Rationalized Plunder – Scotus and the General Welfare

By Rodney Dodsworth – April 2, 2016

A little known scotus decision from 1937 set the stage for our accelerating slide into national bankruptcy. In Helvering v. Davis, an intimidated scotus in the midst of a horrible Great Depression upheld the constitutionality of the Social Security Act. Sold as something resembling a modern Individual Retirement Account, proceeds from worker’s paychecks were supposedly placed in an individual’s government account which drew interest.

Administration lawyers argued that the Constitution’s Article I § 8 powers to “lay and collect taxes” and provide for the “general welfare” were all the justification it needed to transfer wealth among citizens.

The practical meaning of ‘general welfare’ had long been contentious. From the Constitutional ratification debates beginning in 1787 down to the New Deal, what can be termed a Madisonian view held sway. By this, the general welfare clause was part of a broad statement involving the purpose of government. If government was to secure, as per the Declaration, an individual right to pursue happiness, it merely followed that promotion of the good of society was a legitimate general goal. In pursuit of this goal, in support of this broad policy, government had certain functions and powers which were itemized in the Constitution, particularly in Article I § 8.

Despite scattered attempts from 1789 to before the New Deal, congress avoided the temptation to enrich the few at the expense of the many.

This isn’t to say that the intent of FDR and congress wasn’t “good.” Yet there is no Constitutional or Natural Law justification to redistribute wealth. It is here, where government attempts to relieve suffering or discomfort, that we view the bold difference between that which is legal and that which is just. (See also blog post from March 3rd 2016)

Just law complies with Natural Law, the Law of Reason. Our Founders regarded compliance with Natural Law as the prerequisite to human law or legislative statutes. The Framers were correct, not because they said so, but because manmade statutes in violation of Natural Law lead to societal misery.

Wealth transfer, whether in the form of Social Security Old Age, Social Security Disability, Medicare, Medicaid, Obamacare, SNAP, . . . welfare of any sort takes the right property of one for the use of another; they are gross violations of Natural Law and are therefore unjust.

Not only are they unjust, but these violations of Natural Law have done enormous damage to society. Instead of encouraging the growth of families in order to care for the elderly, society quietly shuffles its old into warehouse nursing homes. Similar damage is done when the system encourages teenage girls to have babies out of wedlock. Finally, the money plundered from those who pay is no longer available for productive investment.

Oh, and since they are “entitlements,” the lack of revenue can’t stop the wealth transfer. Borrowed or fiat currency fills the shortfalls.

When Natural Law is dismissed, majorities rule. Two wolves and a sheep decide not only what is for dinner, but who pays for it.

Thank scotus and Helvering v. Davis.

Government aid in any form only helps the government grow. Endless examples exist of government help costing more than the intended help achieved.