By the Numbers: Three Progressive Reasons to Support a Fiscal Responsibility Amendment

by Vickie Deppe – April 2024

Last month, we talked about Scott Pelley’s interview with Federal Reserve Chairman Jerome Powell, who described the national debt as both “worrisome” and “urgent.” We also touched on Dr. David Primo’s observation that a constitutional amendment is the only way to impose ongoing fiscal restraint on Congress. Most advocates talk about these matters in a way that speaks to conservatives but alarms progressives, who fear that cuts to federal spending will hit our most vulnerable neighbors the hardest. This month, we’ll examine some of the ways continued deficit spending imperils social safety net programs.

- Waste, fraud, and abuse: Mismanagement of taxpayer dollars is ubiquitous in Washington. Exposés have been published for decades by everyone from United States Senators to Politico to watchdog groups. Centers for Medicare & Medicaid Services data show that 2023 Medicaid improper payments totaled over $50 billion. In its 2023 Prime Cuts report, Citizens Against Government Waste identified hundreds of recommendations with potential savings of over $400 billion in the first year and $4 trillion over five years, none of which jeopardizes quality governance or social safety net programs. A fiscal responsibility amendment will force Congress to scrutinize spending, slash pork, and eliminate waste instead of coasting along with incremental increases to every. single. thing. they spent money on last year. What is your state’s share of $4 trillion?

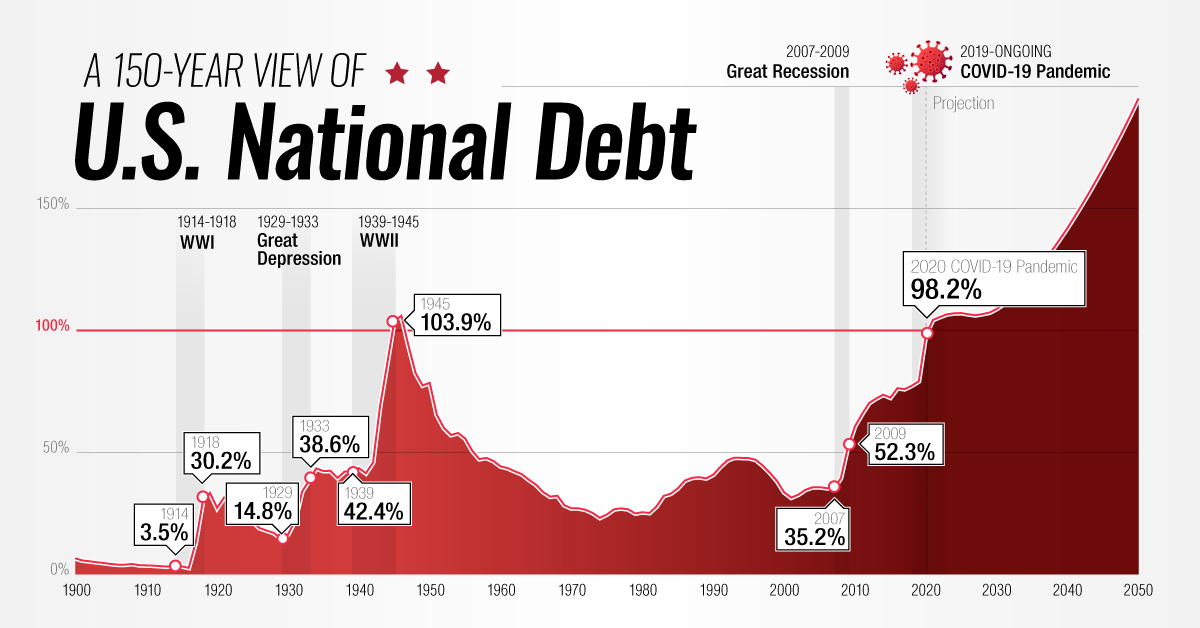

- Sovereign debt throttles economic growth: The World Bank has estimated that for every point above a 77% debt-to-GDP ratio, economic growth is throttled by .017%. Our debt-to-GDP ratio is currently over 100%, and the Congressional Budget Office (CBO) projects it to reach 202% by 2051. This means that over the next 25 years, the United States’ economic growth will be slowed by approximately .5-2% every year. Slower economic growth means fewer jobs and less tax revenue, which puts added stress on our social safety net programs.

- Income inequality has increased as the national debt has grown: The CBO reports that inflation-adjusted after-tax household income for the wealthiest 1% more than doubled from 1979-2019; at the same time, that of other Americans had grown by only 33-75%. These trends are projected to continue going forward. Worse, according to an International Monetary Fund study surveying economies from 1950-2006, greater income inequality further throttles economic growth, combining with high levels of sovereign debt to create a downward spiral that most severely impacts economically vulnerable families. Higher debt correlates with greater income inequality. Income inequality is a drag on economic growth.

Americans—particularly our most vulnerable neighbors—need state legislators to work together…yes, across the aisle…to impose spending reforms on Washington. They’re not going to do it themselves. They can’t do it themselves. Left to itself, Congress has engineered a system that transfers ever-increasing levels of wealth to the already wealthy while creating a massive burden of sovereign debt that does the most harm to those who can least afford it.

Leave A Comment