US Debt-to-GDP Ratio Worsens Further, Despite Solid Economic Growth, as Government Debt Balloons at a Scary Pace

The economy grew solidly. The debt spiked

By Wolf Richter – February 1, 2024

Estimated Reading Time: 2 minutes

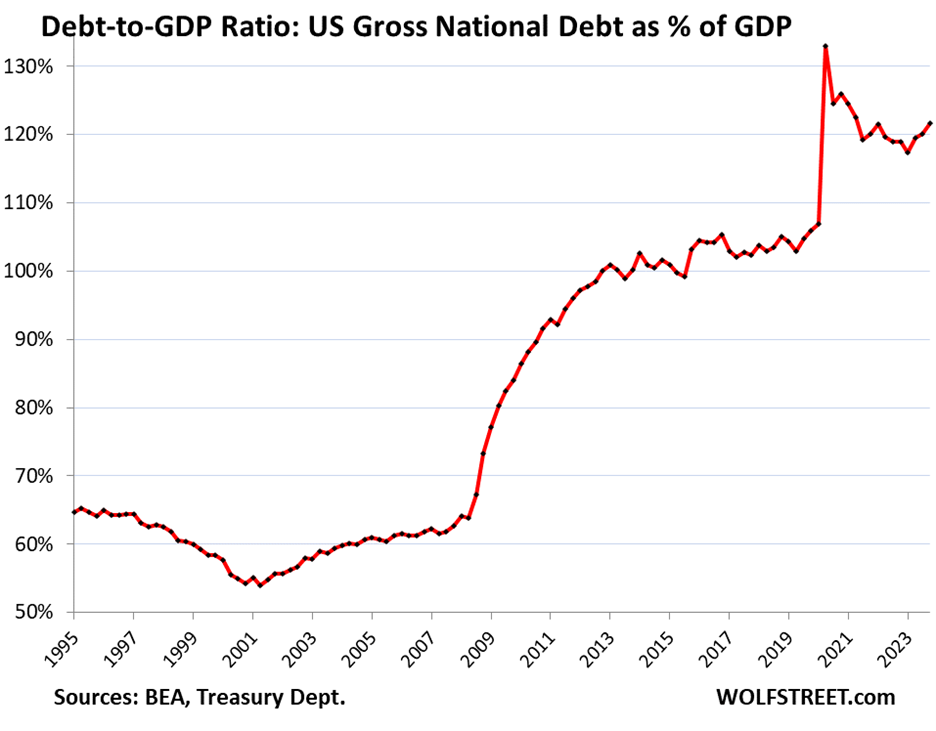

The US government debt is measured in “current dollars,” meaning: not adjusted for inflation. So we compare it to GDP in “current dollars,” not adjusted for inflation. The hope is that the current-dollar GDP, grew faster than the current-dollar debt so that the burden of the debt on the economy would shrink and that the astronomical debt-to-GDP ratio would decline. But no.

Current-dollar GDP grew by 5.8% in Q4 year-over-year, and it did so despite the 5%-plus interest rates, and that was pretty good. But the current-dollar government debt, oh dearie, it grew by 8.2%!

So the Debt-to-GDP ratio worsened to 121.7% at the end of Q4, after having already risen in the prior two quarters.

The spike in Q2 2020 to 133% had occurred largely because GDP had collapsed, and to a lesser extent because the debt had begun to jump. Then, as the economy leaped out of the hole and then grew faster than the debt through Q1 2023, the Debt-to-GDP ratio declined.

But in Q2, Q3, and Q4 2023, it went in the wrong direction, as the government opened the spending floodgates and piled on debt at a scary rate, despite decent economic growth.

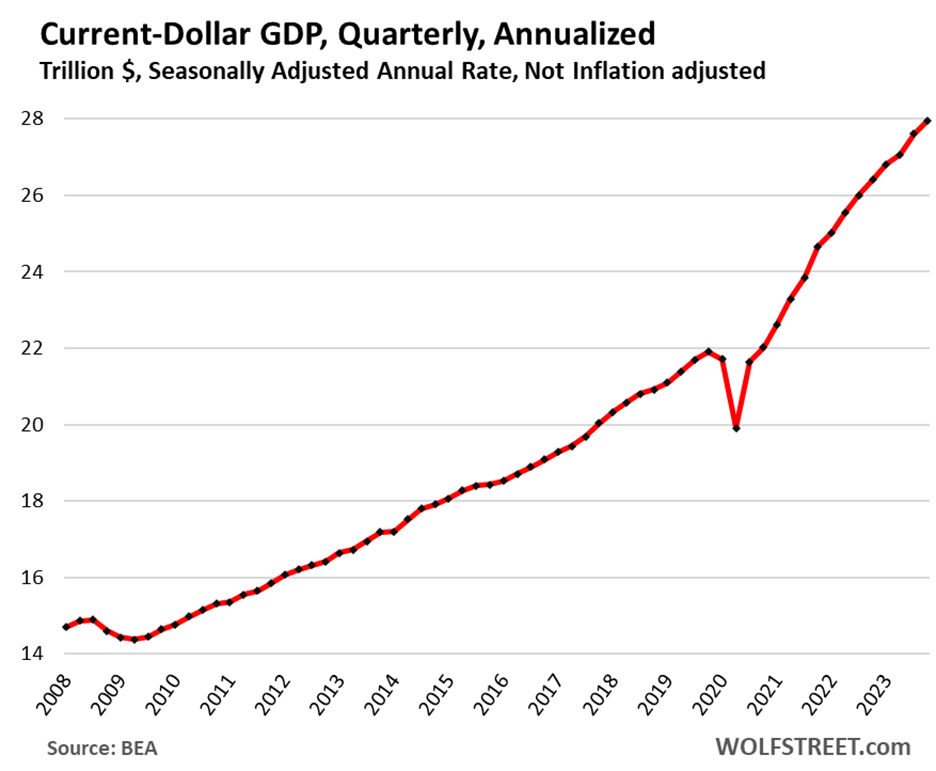

This is the size of the economy: Current-dollar GDP (not adjusted for inflation) in Q4 rose by 5.8% year-over-year to $27.9 trillion, according to the Bureau of Economic Analysis on Thursday: The Year of the Recession that Didn’t Come. Over the past four years, it grew by 27.6%.

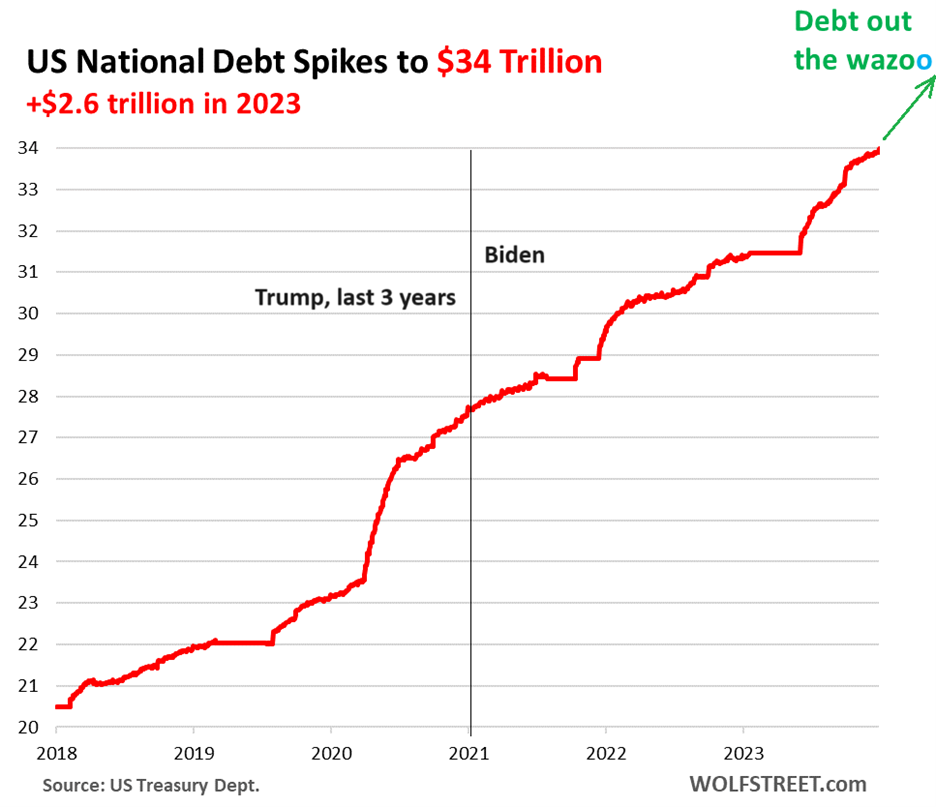

And this is the size of the US debt: $34.0 trillion at the end of 2023. And we marked this day here by tearing out our hair.

In 2023, the debt grew by $2.58 trillion or by 8.2%, a gigantic surge, especially during non-recessionary times. This spending of borrowed money also represents a huge amount of fiscal stimulus handed to the economy, and it’s practically impossible to even have any kind of slowdown, much less a recession, with this kind of fiscal stimulus washing over the land.

Over the past four years, the debt grew by 46.5%, while the economy grew by only 27.6% (both in current dollars). The green label in the chart is the technical jargon for what is going on here that we’ve used for many years, at first jokingly, but in recent years it has become reality:

None of this includes unfunded liabilities of $100 – $200 Trillion, depending on how it’s counted. We’re on a raft headed for a waterfall, and Big Govt in DC is paddling faster and faster toward the falls.