Phoneix Balanced Budget Amendment Planning Convention, Sept. 2017

By Mike Kapic – February 2, 2026

Summary

Authoring an amendment to the Constitution will be an ardent and all-encompassing task requiring many considerations necessary for success into future centuries.

Considerations for constructing a fiscal draft include: a budgeting amendment toward future and effective laws, Court interpretations, ratification, and the effort to identify as many unintended consequences as possible. In addition, the significant differences in accountable budgeting experience between states and the national government should be recongnized. Understanding other nations experiences for dos and don’ts would be useful.

A BBA/FRA (balanced budget amendment/fiscal responsibility amendment) are considered one in the same here. Much of the following amendment considerations are from Prof Rob Natelson’s work. Rob Natelson presents a sample balanced budget amendment only as a guide with suggested dos and don’ts. This is intended to assist in the amendments design.

***

Drafting a BBA/FRA at Convention

Commissioners will find themselves with the same blank sheet of paper the Framers began with and also the significance of the task ahead.

The challenges will be great for delegates in drafting a budgeting amendment to hold their national government fiscally responsible to the people. They might consider a secret convention enabling them to focus on the task and minimize outside interference.

After recovering from a series of bankruptcies in the 19th century, our States began adopting balanced budget amendments to their constitutions and, for the most part, they’ve worked. Three dozen nations also have some form of budgeting process.

Following the states budgeting processes might be a source of guidance but the differences in complexity will require careful consideration. Preparation and assistance from state financial executives and economists would be valuable.

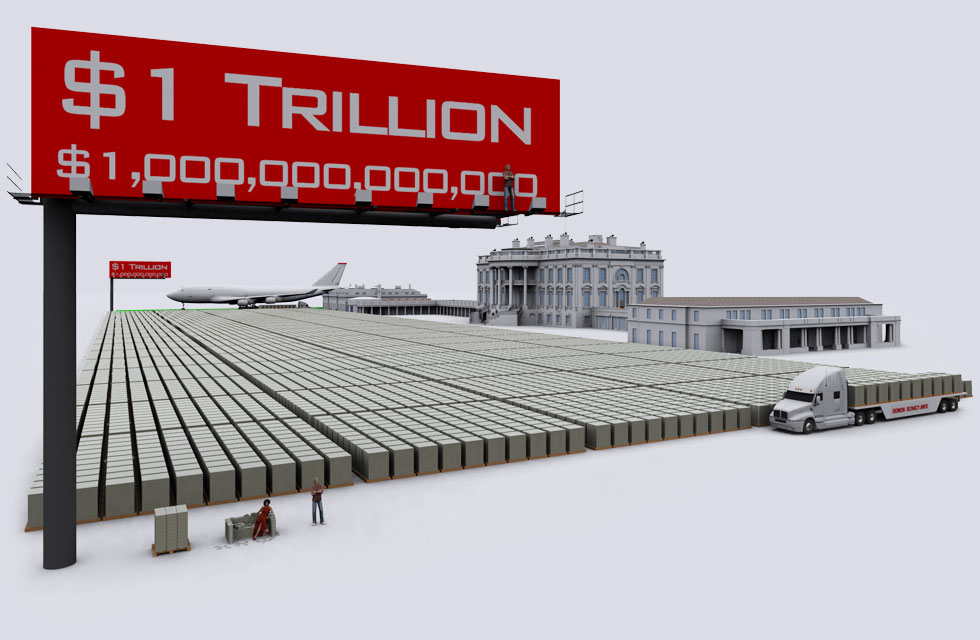

The U.S. debt has doubled in the last decade causing credible fears in financial markets. The Federal government has run deficits 74 out of 85 years since 1940 accumulating today’s nearly $40 trillion debt. The U.S. national debt has approached 100% of our GDP with surging interest costs and budget deficits around 6% of GDP.

http://Demonocracy.info

Since the early 20th century, three dozen countries have adopted balanced budgets but these economists (Merrifield/Poulson) have focused on Switzerland and Germany. Both nations adopted fiscal balanced budget rules, one successfully and the other not so. Common fiscal rules include deficit and debt rules, revenue rules, and expenditure rules. In addition, a “no bail-out” clause became a key element.

They identified the nations federalism structure as an important element in the success and failure of their samples. A study of other nations experiences in introducing fiscal rules of debt and deficiet, revenue and expenditures will be necessary.

There are too many elements and topics for consideration that aren’t identified here because the subject is so complex.

Since the BBA/FRA is about America’s foundation, the convention is compelled to have non-partisan agreement with the convention’s majority vote. Delegates should design the amendment targeting the 38 state legislatures (3000 legislators minimum) or 38 states people in conventions for approval. Due to the complexities of the amendment, a new ‘federalist paper(s)’ may be required as it was in 1788.

The following are a summary of drafting suggestions from the leading Article V expert, Rob Natelson.

Convention Draft Considerations

- The proposal should align with the Constitution’s existing text and style.

- It must be concise to avoid public suspicion and facilitate ratification.

- Key terms should be consistent with those used in the Constitution to minimize ambiguity.

- The language should limit opportunities for manipulation and judicial intervention.

- Exceptions should be procedural rather than definitional to prevent misuse.

- Focus on federal debt limits is one way to reduce judicial involvement.

- Focus on state legislatures to serve as check on federal power and debt increases.

The draft should avoid ineffective provisions and coalition building that might hinder its ratification.

- Do not include complex economic formulas or supermajority requirements

- Keep the BBA free of added provisions that could alienate potential supporters.

- Point the BBA at Congress so as to encourage statue support. See Merrifield/Poulson

The draft should cross-reference specific constitutional clauses pertinent to clarifying and mitigating complexity. See the Natelson example here.

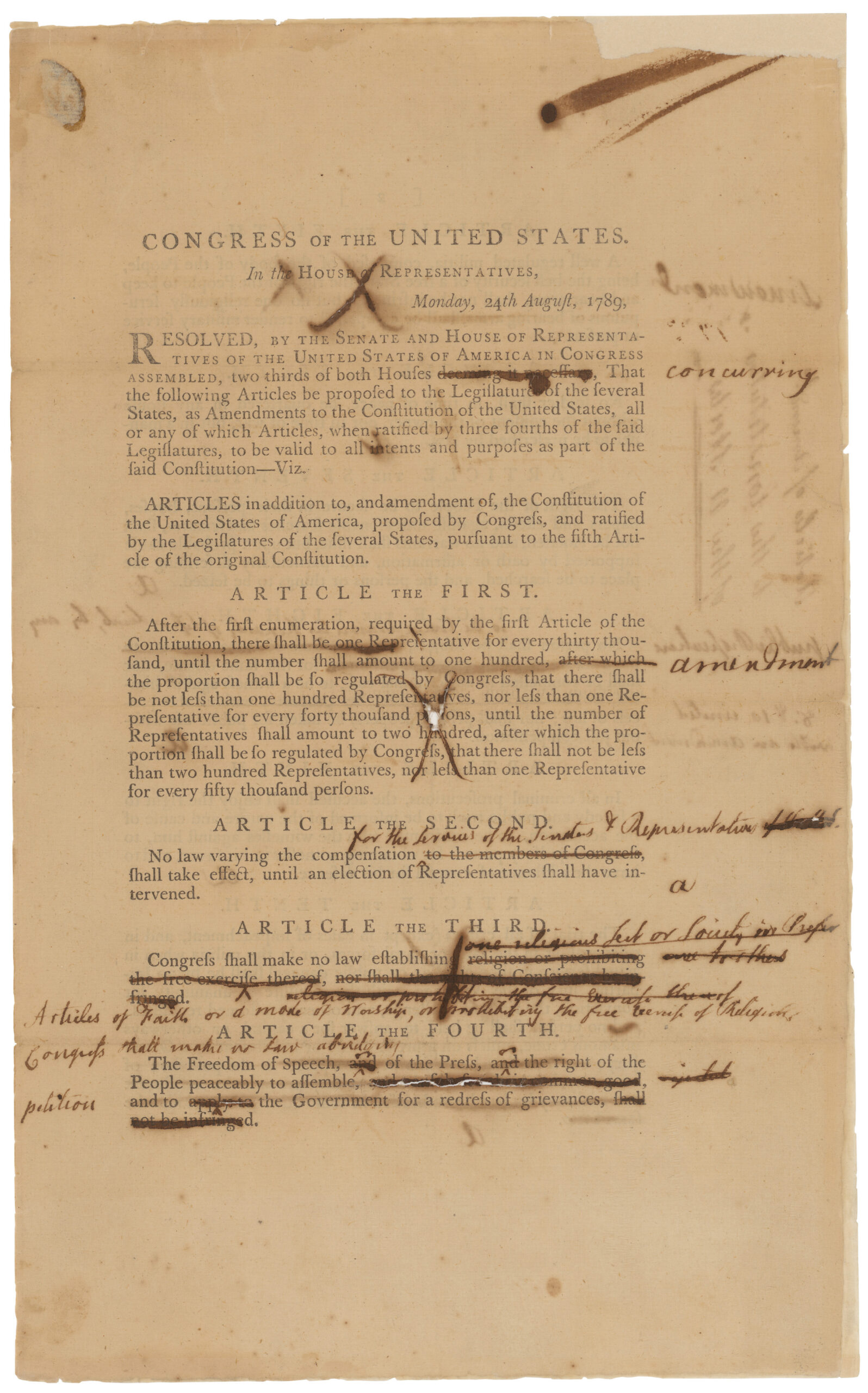

Draft of Bill of Rights, page 1

The proposed amendment(s) should aim to regulate increases in public and contingent public debt.

The sample BBA suggests two stipulations requiring the states approval for any debt increase.

- It stipulates that an increase in federal debt necessitate a majority of state legislatures approval.

- It aims to enhance fiscal responsibility and accountability in borrowing practices.

The Necessary and Proper Clause supports Congress’s authority to enforce amendments through appropriate legislation. A Debt Commission encouraging accountability laws is encouraged.

The brevity of the sample BBA meets historical norms at 281 words.

- The 27 amendments contain approximately 3100 words for 115-word average.

- The 14th Amendment has 423 words, the longest.

- The 2rd Amendment has 27 words, the fewest.

- Congress’s SJR 58 1982 BBA proposal contains 367 words.

The debt braking mechanism of other Nations are long and complicated and would require further modification studies to effect incorporation into America’s constitutional federalism system. For instance, rather than a people’s referendum, a supermajority of states for inclusion may be instituted in the budgeting decision process. Each house of Congress already enjoys full authority to adopt legislative rules to assist compliance.

A U.S. Congressional Debt Commision could be the implementation tool for the BBA/FRA.

The amendment should provide for exceptions without permitting exceptions to become the norm. Minimize judicial involvement. The BBA should not decide more than the issue at hand.

For a full explanation of Prof Natelson’s suggested guidelines for composing a BBA click here. The balanced budget is to be a fiscal responsibility amendment designed to renew and improve discussion, not to end it. The debt brake (Merrifield/Poulson) is just one of many options available to delegates.

Standard financial accounting rules are required of every American and institution in America except Congress. It should be considered in statutes resulting from the BBA/FRA amendment(s) such as the elements in the BoFR (Bill of Fiscal Responsibility).

State commissioners approaching the creation of this BBA/FRA amendment should consider their task as a renewal of the Constitutions covenant with the American people.

Next, Part V, Ratification

Leave A Comment