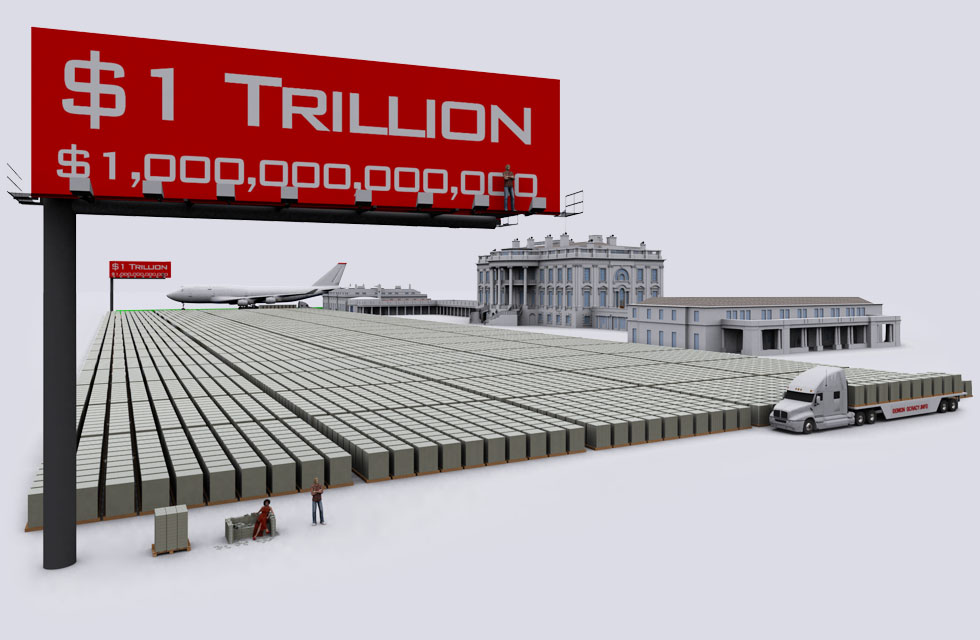

Multiply this picture times 32 for a more accurate debt for today.

What Happens If the Government Outspends Its Ability to Pay?

What it looks like when the financial walls close in.

By Peter Jacobsen – August 30, 2023

For “Ask an Economist” this week, I have two questions from J.R. He says,

“My question is what happens when the government continues to spend out of control where it potentially out spends its ability to pay its bills/debt?

With the national debt over $30 trillion and climbing when do you think we will hit the tipping point and what do you think will happen?”

So what happens if we can’t pay our debts? To understand, we need to think about where the government’s money comes from.

Three Sources of Government Spending

Where does the government’s money come from? Unlike private businesses and households, the government doesn’t sell services to voluntary buyers in order to cover its expenditures. As you likely already know, the government’s money comes from us—the taxpayers.

However, there are three different ways the government extracts resources from us: taxation (T), debt financing (D), and money printing (M). Government spending (G) is equal to the sum of these three sources of funds. In math terms:

G=T+D+M

Taxation is the most straightforward source of government funds. The government taxes incomes, spending, property ownership, property sales, and death. If the government simply spent that money and stopped, that would be the end of the story. But it isn’t.

For over two decades now, the U.S. government has had more spending than tax revenue. When spending exceeds tax revenue, this is called a deficit. So the deficit is the difference between government spending and tax revenue, or G-T. Mathematically we can express the deficit as follows:

G-T=D+M

This new equation shows that the government deficit must be paid by the remaining sources of revenue: debt financing and money printing.

At this point someone may argue that we could simply raise taxes to eliminate the deficit. And that works—until it doesn’t. The problem with relying on tax increases to support spending is that tax increases have a limit to how much additional revenue they can bring in. To understand why, ask yourself a simple question: if the government tried to tax income at 100%, how much revenue would they collect? The answer is zero. There would be no reason to work for money if the government took every cent you earned, and even if people did work for no pay, they’d die of starvation. Taxes disincentivize work. Past some tax rate, the government disincentivizes work so much that it actually receives lower revenue. This was famously illustrated by economist Art Laffer’s Laffer Curve. The curve illustrates plainly that as you increase the tax rate, you collect more revenue at first, but eventually the revenue begins to fall as the rate gets too high and begins discouraging work.

What rate provides the “maximum” tax revenue is up for debate, but the fundamental logic of the Laffer curve is not. There is a maximum amount of revenue the government can earn via taxation. Once it’s collecting at this maximum, the government only has two remaining tools to support spending.

Let’s talk about debt first. To begin, although it’s not immediately obvious, debt is also ultimately paid by taxpayers. If the U.S. government gets a loan today, that loan must be repaid. How can the U.S. repay loans in the future? Future taxes. So debt kicks the cost down the road somewhat, but the taxpayer ultimately still holds the bag.

So can the government simply keep borrowing forever to cover spending? No. Much like with taxation, there is a sort of Laffer curve for debt financing too. If the government wants to attract more lenders than it already has, it has to offer something in return—more money. This takes on the form of higher interest rates. So maybe lenders were unwilling to lend $100 to the government at a 3% rate, but if the government offers 4% they will jump in.

The problem is you run out of willing lenders at 4%. The government then has to offer 5%. This process continues until the interest rate is so high that the net proceeds collected by issuing bonds (sometimes called debt seigniorage) actually begins to fall. Much like the revenue-maximizing tax rate, there is an interest rate at which the revenue for issuing debt falls.

So if tax revenue can no longer be raised, and issuing more debt is no longer an option, we are left with only one option—print money.

Governments who run out of tax revenue and debt finance can only pay their bills by inflationary monetary policy. This sort of policy is disastrous for the economy. As the currency loses value, savings are destroyed, citizens have to spend real resources to quickly convert currency before it loses all value, and investment dries up.

Meanwhile, a less valuable currency means government spending will increase even more if government officials want to maintain the same spending habits. At this point the only way to stop the economic chaos is to stop spending.

Where Does the U.S. Stand?

The first part of J.R.’s question was the easy part. It’s theoretically pretty straightforward to understand what happens if government spending outpaces the government’s ability to pay debts: the money-printers get to work. The harder question is, where is the U.S. in this process?

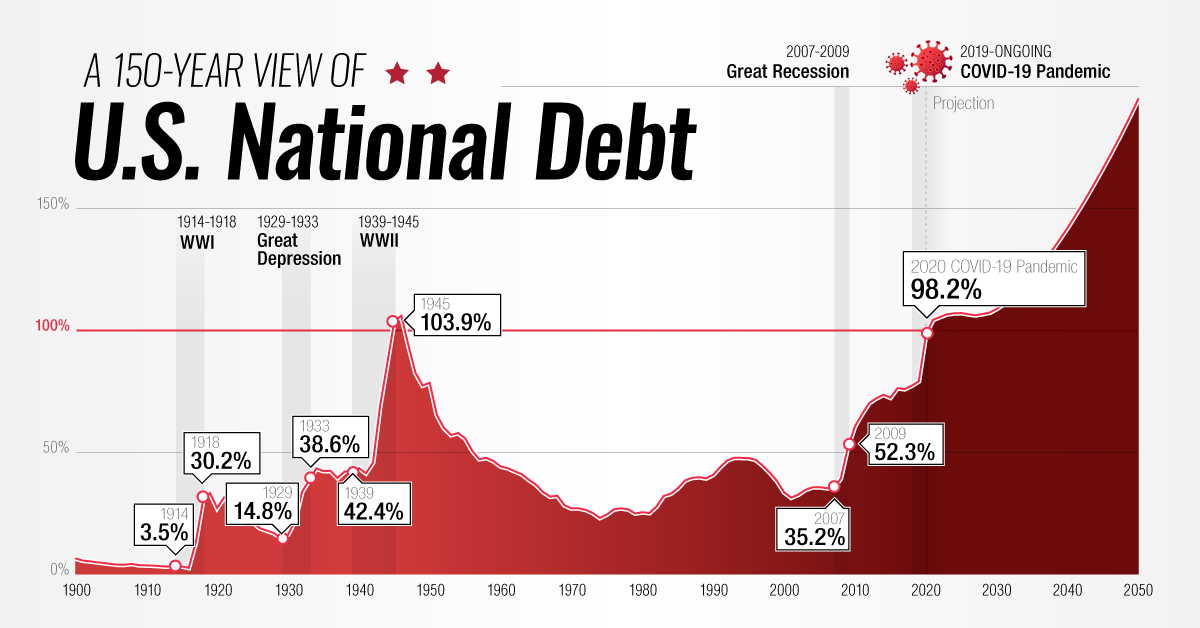

Debt is clearly an issue in the U.S. As the data show, the level of debt relative to spending has been climbing and spiked to unprecedented levels during the COVID-19 policy era.

However, I have to disappoint when I say I can offer no honest predictions apart from the fact that I don’t think a crisis is happening soon.

I give this answer for two reasons. First, I don’t have any investments on the line that predict collapse. If the U.S. government descended into a hyperinflation hellscape, there would probably be a way to arrange my financial portfolio in such a way that I’d make money from it.

I haven’t made any bets against the well-being of the U.S., so it would be dishonest of me to claim I’m expecting a collapse any time now. When someone predicts doom, always ask if their money is where their mouth is. My money is in pretty straightforward assets—many of which would do very poorly in light of a U.S. financial crisis.

The second reason I won’t predict imminent collapse is that I’m not sure that U.S. productivity gains will be unable to keep up with growing debt. Again, the rising debt-to-GDP ratio is concerning, but past debt-to-GDP ratios are not perfect predictors of future debt-to-GDP ratios.

Much like personal debt, the government can safely borrow so long as future incomes can pay for that borrowing. If U.S. citizens become richer, the government gets more revenue to pay off debts.

So, in summary, I think the recent trend of U.S. debt is very bad. If the trend continues, there will be serious consequences. In the short term, though, I don’t see any major changes right around the corner. I could be wrong. I hope I’m not. Economics provides a solid way to understand tendencies, but it provides no crystal balls for fortune telling.

Peter Jacobsen is a Writing Fellow at the Foundation for Economic Education.